Assistant Contact Center Manager I bei Members First Credit Union

Members First Credit Union · Midland, Vereinigte Staaten Von Amerika · Hybrid

- Professional

- Optionales Büro in Midland

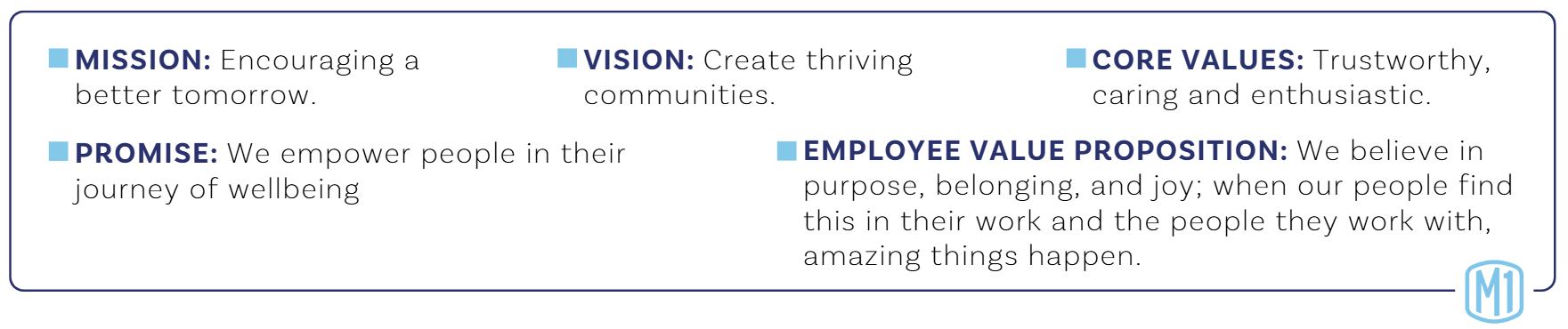

Would you find purpose and joy in developing and empowering a call center team and guiding members on their financial journey? Do you thrive in a fast-paced environment supporting team, leadership, and operations? Members First Credit Union is seeking an Assistant Contact Center Manager I in Midland, MI, with 1–3 years of experience. Apply today and join us in our mission to encourage a better tomorrow!

We strive to create an atmosphere of belonging with no judgment, just opportunity. We are interconnected to each other, and when we embrace our true authentic selves, we are stronger. We will empower you to be the best version of yourself while helping you to flourish in work and life. Come join us to help create thriving communities!

ASSISTANT CONTACT CENTER MANAGER I

Grade 9/Non-Exempt

Reports to: Contact Center Leader

The primary purpose of this position is to assist Members First Credit Union to deliver on its mission, vision, and brand promise. You will do this by living out our core values in every service contact to both internal and external members. At the heart of our Employee Value Proposition lies the belief in purpose, belonging, and joy, fostering a culture where every team member feels invested and encouraged to make a meaningful impact in the lives of others.

Essential Duties

- Lead the team to maximize productivity, efficiency and the team potential. This includes but is not limited to onboarding, monitoring development/performance, coaching, training, assuring compliance with regulatory requirements are followed, organizational strategic plan, mission, vision, values, policies and work requirements.

- Assist with appraisals for performance and provide recommendations for team promotions, and progressive discipline through termination as appropriate. Oversees and upholds the visual standard for department.

- Deliver on the Credit Union’ Service Promises in every service situation.

- Responsible for department when department leader is out of the office

- Successfully obtain Certified Credit Union Financial Counselor (CCUFC) designation through America's Credit Unions within first year of service with M1.

Duties and Responsibilities

The following statements are intended to describe the general nature and level of work being performed by this position. It is not intended to be an exhaustive list of all duties, responsibilities and skills required of this position. Other duties may be assigned to meet business needs.

- Ensure that staff is cross trained accurately to provide timely, accurate, and quality service

- Conducting, reviewing, and coaching team members on quality control on phone calls to verify that standards for member experience are met and/or exceeded with each member contact point.

- Assist with coaching the Contact Center team members to use effective sales skills and behaviors, offering prospective and existing members products and services that will help to fulfill their financial needs.

- Establish, monitor, and improve initiatives/procedures to improve the efficiency and effectiveness of member services without decreasing the audit trail and security of any entries and to ensure that all record keeping is current and accurate

- Assists with Integration of new products, services, policies, regulation updates, and system upgrades and project deployments. Ensure that team members are confident and up to date on changes to effectively service the membership.

- Supervise employees in the department, interviewing potential employees, arranging employee work schedules, maintaining and submitting records on employee hours, and performing employee reviews and disciplinary action.

- Assist with leading a Contact Center team that strives for continuous improvement of the member experience, fostering a positive working environment for employee empowerment through leadership, coaching, and support.

- Assist with training and implementing the Strategic Development for the department

- Monitor performance of department through established metrics while continuing to discover greater efficiencies allowing for deeper member relationship building.

- Planning, scheduling, coordinating and evaluating the contact center work flow while supporting the Contact Center Team.

- Attain Financial Counselor Certification (CCUFC) within first 6 months

- Collaborate with project teams to implement new Contact Center technology; and assist with managing vendor relationship post-implementation.

- Resolve account problems and provide information to members efficiently and professionally while maintaining a high level of confidentiality as needed.

- Generate and review contact center reports and follow up with the team member to provide additional knowledge needed to help the team understand how the department is reaching the goals that are set by the Credit Union.

- Continuously look for additional opportunities to improve the efficiency of the department through technological improvement updates.

- Attend educational opportunities and meetings as required. Prepare pre and post write-ups on the educational experience and ideas for implementation.

- Deliver a trustworthy lending by phone application experience that aligns with our lending strategies

- Other duties as assigned.

General Sales Expectations

- Successfully use effective skills and behaviors that will allow for coaching and leadership support to the Contact Center team.

- Build relationships with current and new members. Offer products and services that will help to fulfill their financial needs

Community Relations

- Participate with department employees in getting involved in community events at least 4 times per year.

- Maintain involvement in community groups for purposes of developing new business prospects and raising awareness of the credit union.

- Be a visible presence in the local community. Promote the credit union and gain leads through participation in business, community, chamber, and charitable activities as assigned

Qualifications and Expectations

To perform this job successfully, an individual must be able to perform each essential duty satisfactorily. The requirements listed below are representative of the expectations of the person performing this job.

- Strive to exceed credit union, department, and personal goals.

- Understands deadlines and meets set time lines.

- Strong leadership skills.

- Team oriented.

- Highly organized.

- High reasoning ability.

- Produces accurate work results.

- Readily keeps others adequately informed.

- Maintains a high level of knowledge of credit union philosophy, products/services, policies and procedures.

- Maintain good knowledge of all State and Federal laws governing credit union operations (BSA, Patriot Act, Regulation CC, Regulation E, Truth in Savings, Truth in Lending, etc.).

- Implements new procedures and processes efficiently and effectively.

- Ability to work overtime, attend meetings, seminars and travel.

- Proactively seek opportunities to fulfill the Internal Service Missions of the department and the credit union.

- Must have flexibility to deal with changing work hours and locations as needed.

- Will be willing and able to file documents as required.

- Courtesy, tact, and diplomacy are essential elements of the job. Work involves personal contact with others inside and /or outside the organization generally regarding routine matters for purposes of giving or obtaining information, which may require some discussion

- Effectively apply and maintain financial counseling concepts, gained through America's Credit Unions' Financial Counseling Certification Program (FiCEP), to promote financial well-being.

Physical Requirements

The physical demands described here are representative of those that must be met by an employee to successfully perform the essential functions of this job. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions.

- Ability to move or transport up to 25 pounds.

- Able to remain stationary for 2-4 hours at a time.

Work Environment

- Must maintain a neat and orderly work area.

- Routinely clean and disinfect work areas (i.e. teller stations, desk surfaces, phones, electronic equipment).

- Protect the confidentiality of credit union staff and members by locking door or removing items from desk/workstation when away.

Education and Experience

- Minimum of one to two years of experience in management or supervisory capacity

- Minimum of one to two years of experience in contact center industry

- Minimum of one year of previous banking and/or credit union experience

- Minimum high school graduate or equivalent

- One to three years similar or related experience

- Must be fully competent in the use of contemporary software, word processing, spreadsheet applications.

- Must possess excellent interpersonal and written communication skills

- Skills in Microsoft Word, Excel, and Outlook