Hybrid Consumer Loan Processor I bei Members First Credit Union

Members First Credit Union · Midland, Vereinigte Staaten Von Amerika · Hybrid

- Junior

- Optionales Büro in Midland

Are you experienced in preparing and processing consumer loans and enjoy working both independently and collaboratively? Do you excel at identifying and driving process improvements and efficiencies to better support our teams, partners, and members? Members First Credit Union is seeking an experienced Consumer Loan Processor I with a minimum of one year of experience in a financial institution to join our highly motivated team.

We strive to create an atmosphere of belonging with no judgment, just opportunity. We are interconnected to each other, and when we embrace out true authentic selves, we are stronger. We will empower you to be the best version of yourself while helping you to flourish in work and life. Come join us to help create thriving communities!

CONSUMER LOAN PROCESSOR I

Grade 5/Non-Exempt

Reports to: Consumer Lending Leader

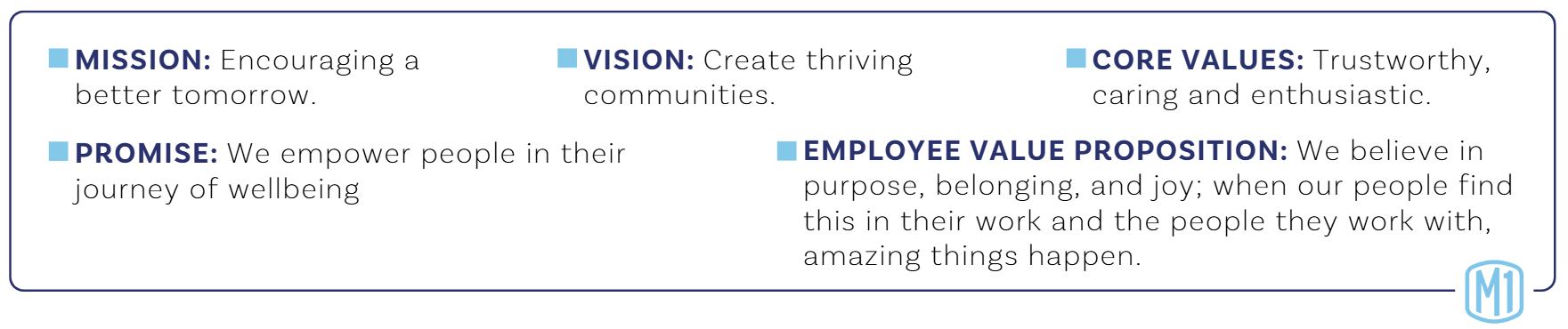

The primary purpose of this position is to assist Members First Credit Union to deliver on its mission, vision, and brand promise. You will do this by living out our core values in every service contact to both internal and external members. At the heart of our Employee Value Proposition lies the belief in purpose, belonging, and joy, fostering a culture where every team member feels invested and encouraged to make a meaningful impact in the lives of others.

Essential Duties

- Maintain continuing education on consumer Federal and State regulations and stay in compliance in all situations.

- Maintain and develop product knowledge base.

- To perform certain specialized clerical functions as required

- Fund all consumer loans as they come into Lending 360.

- Process Indirect Loans that come in for funding according to Indirect Funding instructions

- Successfully obtain Certified Credit Union Financial Counselor (CCUFC) designation through America's Credit Unions within first year of service with M1.

Duties and Responsibilities

The following statements are intended to describe the general nature and level of work being performed by this position. It is not intended to be an exhaustive list of all duties, responsibilities and skills required of this position. Other duties may be assigned to meet business needs.

- Deliver on the Credit Union’ Service Promises in every service situation.

- Inform new and potential members about our MFCU products and services and how they can benefit from these products & services.

- Provide prompt, professional, helpful, knowledgeable and courteous member service to coworkers, members and dealer partners.

- Answer questions effectively and provide information as requested.

- Ability to work as a team and individually to accomplish tasks of the consumer loan department.

- Prepare and process all paperwork needed to finalize a consumer loan for all Origence Lending 360, Allegro Indirect deals or Symitar loans when needed. .

- Obtain proof of income from the member(s), proof of insurance on collateral and secure all documents and signatures to perfect any liens or notes and security agreements.

- Set up electronic transfer requests or order payment books requests from Indirect deals

- Prepares documentation for new accounts and processes same on computer system

- Process all checks for Dealer payoffs, Insurance and financial institution payments and other mail as required

- Processing and updating validated titles from RD 108’s and paper titles that come through email and the mail

- Upload dealer deals that come through the mail to Allegro and mail out welcome letters once loan is funded

- Review and complete Loan Processing service events in Synapsis, daily

- Review and email or process Synapsis events LSI ticket from lending member requests.

- Processing Gap/Insurance claim checks and updating loan record and logs as needed.

- Loans to zero report weekly and mail out Lien Release to member.

- Audit Skip A Pay processed by Loan Officers

- Check dealer loan report weekly.

- Process daily audits for loans all completed consumer loans.

- Other duties as assigned.

Qualifications and Expectations

To perform this job successfully, an individual must be able to perform each essential duty satisfactorily. The requirements listed below are representative of the expectations of the person performing this job.

- Strive to exceed credit union, department, and personal goals.

- Works autonomously.

- Meets deadlines.

- Team oriented.

- Produces accurate work results.

- Readily keeps others adequately informed.

- Presents a professional image.

- Maintains a high level of knowledge of credit union products and services.

- Attend educational functions as required.

- Ability to communicate with members and other staff members clearly and concisely.

- Must have a good knowledge of State and Federal laws governing the lending process.

- Good organizational skills, attention to details with solid time management skills and well-developed abilities to multi-task.

- Ability to work overtime, attend meetings, seminars and travel.

- Must have flexibility to deal with changing work hours and locations as needed.

- Courtesy, tact, and diplomacy are essential elements of the job. Work involves personal contact with others inside and /or outside the organization generally regarding routine matters for purposes of giving or obtaining information, which may require some discussion

- Effectively apply and maintain financial counseling concepts, gained through America's Credit Unions' Financial Counseling Certification Program (FiCEP), to promote financial well-being.

Physical Requirements

The physical demands described here are representative of those that must be met by an employee to successfully perform the essential functions of this job. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions.

- Ability to move or transport up to 25 pounds.

- Able to remain stationary for 2-4 hours at a time.

Work Environment

- Must maintain a neat and orderly work area.

- Routinely clean and disinfect work areas (i.e. teller stations, desk surfaces, phones, electronic equipment).

- Protect the confidentiality of credit union staff and members by locking door or removing items from desk/workstation when away.

Education and Experience

- Minimum high school graduate or equivalent.

- Minimum of one-year experience with a financial institution

- One to twelve months similar or related experience

- Must have a working knowledge of loan processing and credit analysis.

- Be able to operate a 10 key calculator and typewriter.

- Skills in Adobe, Microsoft Word, Excel, and Outlook