Community Impact Leader I presso Members First Credit Union

Members First Credit Union · Midland, Stati Uniti d'America · Hybrid

- Professional

- Ufficio in Midland

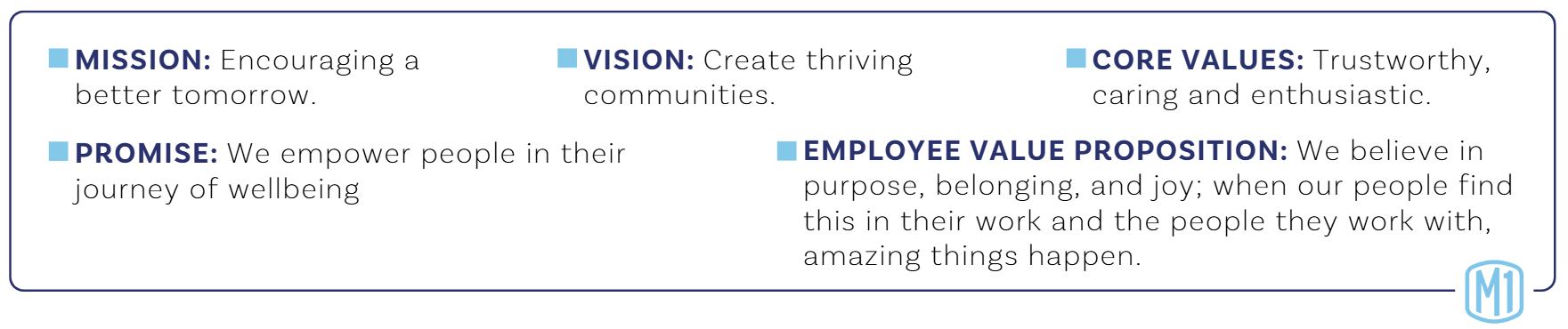

Are you passionate about building community relationships and fostering a culture of giving and empowerment within your team? Members First Credit Union is seeking a strategic Community Impact Leader to drive M1’s outreach, partnerships, sponsorships, and volunteerism efforts aligned with our Giving Pillars: Education, Housing, and Well-being. Evening, weekend hours, and travel are required to support events and foster meaningful connections.

We strive to create an atmosphere of belonging with no judgment, just opportunity. We are interconnected to each other, and when we embrace out true authentic selves, we are stronger. We will empower you to be the best version of yourself while helping you to flourish in work and life. Come join us to help create thriving communities!

COMMUNITY IMPACT LEADER I

Grade 12/Exempt

Reports to: Vice President Marketing

The primary purpose of this position is to assist Members First Credit Union to deliver on its mission, vision, and brand promise. You will do this by living out our core values in every service contact to both internal and external members. At the heart of our Employee Value Proposition lies the belief in purpose, belonging, and joy, fostering a culture where every team member feels invested and encouraged to make a meaningful impact in the lives of others.

Essential Duties

- Lead all community outreach, partnership, sponsorship and volunteerism activities for M1 with a focus on M1’s Giving Pillars of Education, Housing, and Well-being.

- In collaboration with the VP of Marketing, develop a public affairs strategy that strengthens our credit union’s reputation as a partner of choice using the levers of external communications, media, community engagement, philanthropic giving, and team engagement.

- Through leadership, create a positive, empowering environment for team members to allow for goal success and professional development.

- Develop a Community Impact team that has a passion for our members, communities and vision to “Create Thriving Communities”.

- Be a visible presence in the community, actively representing the credit union in the community to foster strong relationships and champion initiatives through the M1’s Giving Pillars. Weekend, evening hours, and travel required.

- This is a hybrid position with the expectations of 3 days in the office.

- Successfully obtain Certified Credit Union Financial Counselor (CCUFC) designation through America's Credit Unions within first year of service with M1.

Duties and Responsibilities

The following statements are intended to describe the general nature and level of work being performed by this position. It is not intended to be an exhaustive list of all duties, responsibilities and skills required of this position. Other duties may be assigned to meet business needs.

Leadership:

- Supervising employees, interviewing potential employees, arranging work schedules, maintaining and submitting records on employee hours, and performing employee reviews and disciplinary action. Provide to VP prior to submitting to Human Resources.

- Collaborate with the Culture & Employee Development team for the Community Impact efforts in connection to bi-annual Community Summit events for team volunteering or acts of giving.

- Lead the Community Impact Team in M1’s vision to “Create Thriving Communities”. This will include:

- Managing the tracking software and the budget.

- Review and make decisions on sponsorship requests.

- Driving the knowledge and expertise on how various philanthropic efforts have an impact on our brand and how it can make a long-term impact.

Community Outreach:

- Develop and implement strategies to create opportunities for M1 to partner with nonprofits, community partners, schools, businesses in support of Giving Pillar (Education, Housing, Wellbeing) initiatives and outreach.

- Ensure M1 is a vibrant presence in the community through volunteer efforts, as well as through organized events. Assist with the coordination and execution of all volunteer activities involving M1 team members and volunteers.

- Attend community events, meetings and forums to represent M1 and strengthen community ties (e.g,, Chambers, Schools, Nonprofit organizations, etc.); serve as a connector to Branch Leaders to assist their Community Impact activities.

- Collaborate with community leaders and organizations to build partnerships and support community initiatives.

- Seek out leadership roles on community boards and committees in branch community areas.

- Act as the liaison to trade associations and industry partners, such as Mid-Michigan Chapter of Credit Unions and the Michigan Credit Union League.

Public Relations & Communications:

- In collaboration with M1's Marketing team, support and create content for social media to promote community impact initiatives and events.

- Maintain monthly Collab Call communication of Community Impact events and initiatives to keep all team members informed.

- Identify recognition opportunities, such as MCUL publications, Americas Credit Union awards, Contact Magazine, etc. Work with the Marketing team, Community Impact Specialist, and other applicable teams to write and submit pieces.

Measurement & Reporting:

- Track and analyze the impact of community engagement efforts using metrics and key performance indicators.

- Provide quarterly Giving Pillar reporting to C-Suite.

- Track and maintain inventory of supplies and donations, as required.

Scholarship Program

- Lead and oversee M1’s annual scholarship program.

- Lead the Swinging for Scholarships annual golf event.

- Attend educational opportunities and meetings as required. Prepare pre and post write-ups on the educational experience and ideas for implementation

- Other duties as assigned.

Qualifications and Expectations

To perform this job successfully, an individual must be able to perform each essential duty satisfactorily. The requirements listed below are representative of the expectations of the person performing this job.

- Ability to motivate and positively influence others

- Self-starter, strong organizational skills, ownership mentality, ability to prioritize workloads, and fast learner.

- Strive to exceed credit union, department, and personal goals

- Be a brand and culture advocate 100% of the time

- Maintains a high level of knowledge

- Ability and comfort in speaking in front of both small and large groups including community events and classroom presentations.

- Manages initiatives successfully from start to finish

- Sets deadlines and does what is necessary to meet them

- Produces accurate work results

- Strong decision-making skills

- Demonstrate excellent communication skills in all forms: verbal, written, and electronic

- Readily keeps others informed through clear interpersonal and written communication.

- Maintains a high level of knowledge of credit union products and services

- Outgoing personality with ability to offer new ideas and network effectively

- Maintain confidentiality with sensitive information

- Weekend, evening hours, and travel required

- Courtesy, tact, and diplomacy are essential elements of the job. Work involves personal contact with others inside and /or outside the organization generally regarding routine matters for purposes of giving or obtaining information, which may require some discussion

- Effectively apply and maintain financial counseling concepts, gained through America's Credit Unions' Financial Counseling Certification Program (FiCEP), to promote financial well-being.

Physical Requirements

The physical demands described here are representative of those that must be met by an employee to successfully perform the essential functions of this job. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions.

- Ability to move or transport up to 25 pounds.

- Able to remain stationary for 2-4 hours at a time.

Work Environment

- Must maintain a neat and orderly work area.

- Routinely clean and disinfect work areas (i.e. teller stations, desk surfaces, phones, electronic equipment).

- Protect the confidentiality of credit union staff and members by locking door or removing items from desk/workstation when away.

Education and Experience

- Three to five years similar or related experience in community event planning, program development, and community engagement.

- A bachelor's degree

- Must possess excellent interpersonal and written communication skills

- Advanced computer skills including some graphic design, website development, and social media communication

- Knowledge of Microsoft software (Work, Excel, Outlook, Publisher, PowerPoint, etc.)

Candidarsi ora